Colo crisis for the UK Internet and IT industry?

April 2007

The UK Internet and IT industries are facing a

real crisis that is creeping up on them at a rate of knots (Source: theColocationexchange).In the UK we often

believe that we are at the forefront of innovation and the delivery of creative content services such as Web 2.0 based and IPTV, but this crisis could force many of these services to be delivered

from non-UK infrastructure over the next few years.

The UK Internet and IT industries are facing a

real crisis that is creeping up on them at a rate of knots (Source: theColocationexchange).In the UK we often

believe that we are at the forefront of innovation and the delivery of creative content services such as Web 2.0 based and IPTV, but this crisis could force many of these services to be delivered

from non-UK infrastructure over the next few years.

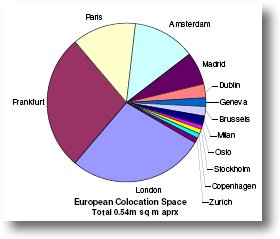

So, what are we talking about here? It's the availability of colocation (colo) services and what you need to pay to use them. Colocation is an area where the UK has excelled and has lead Europe for a decade, but this could be set to change over the next twelve months.

It's no secret to anyone that hosts an Internet service that prices have gone through the roof for small companies in the last twelve months, forcing many of the smaller hosters to just shut up shop. The knock-on effects of this will have a tremendous impact on the UK Internet and IT industries as it also impacts large content providers, content distribution companies such as Akamai, telecom companies and core Internet Exchange facilities such as LINX. In other words, pretty much every company involved in the delivering Internet services and applications.

We should be worried.

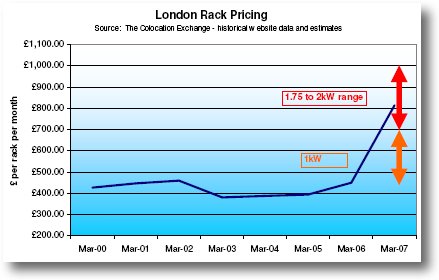

Estimated London rack pricing to 2007 (Source: theColocationexchange)

The core problem is that available co-location space is not just in short supply in London, it is simply disappearing at an alarming and accelerating rate as shown in the chart below (It is even worse in Dublin). It could easily run out to anyone who does not have a deep pocket.

Estimated space availability in London area (Source: theColocationexchange)

What is causing this crisis?

Here are some of the reasons.

London's ever increasing power as a world financial hub: According to the London web site: "London is the banking centre of the world and Europe�s main business centre. It is the headquarters of more than 100 of Europe�s 500 largest companies are in London and a quarter of the of the world�s largest financial companies have their European headquarters in London too. The London foreign exchange market is the largest in the world, with an average daily turnover of $504 billion, more than the New York and Tokyo combined."

This has been a tremendous success for the UK and driven a phenomenal expansion of financial companies needs for data centre hosting and they have turned to 3rd party colo providers to provide these needs. In particular, the need for disaster recovery has driven them to not only expand their own in-hose capabilities but to also place infrastructure in in 3rd party facilities. Colo companies have welcomed these prestigious companies with open arms in the face of the telecomms industry meltdown post 2001.

Sarbanes-Oxley compliance: The necessity for any company that operates in the USA to comply with the onerous Sarbanes-Oxley regulations has had a tremendous impact on the need to manage and audit the capture, storage, access, and sharing of company data. In practice, more analysis and more disk storage are needed leading to more colo space requirements.

No new colo build for the last five years:

As in the telecommunications world, life was very difficult for colo operators in the five years following the new millennium. Massive investments in the latter half of the 1990s was followed by

pretty much zero expansion of the industry which remained effectively in stasis. One exception to this is

IX Europe who are expanding their facilities around Heathrow. However, builds such as this will not have any great impact on the market overall even though it will be highly

profitable for the companies expanding.

No new colo build for the last five years:

As in the telecommunications world, life was very difficult for colo operators in the five years following the new millennium. Massive investments in the latter half of the 1990s was followed by

pretty much zero expansion of the industry which remained effectively in stasis. One exception to this is

IX Europe who are expanding their facilities around Heathrow. However, builds such as this will not have any great impact on the market overall even though it will be highly

profitable for the companies expanding.

However, in the last 24 months both the telecomms and the colo industries are seeing a boom in demand and a return to a buoyant market last seen in the late 1990s (Picture credit: theColocationexchange).

Consolidation: In London particularly, there has been a large trend to consolidation and roll-up of colo facilities. A prime example of this would be Telecity, (backed by private equity finance from 3i Group, Schroders and Prudential), who have bought Redbus and Globix in the last twenty four months. This included a number of smaller colo operators that focused on supplying smaller customers. The now larger operators have really concentrated on winning the lucrative business of corporate data centre outsourcing which is seen to be highly profitable with long contract periods.

Facility absorption: In a similar way that many telecommunications companies were sold at very low prices between post 2000, the same trend happened in the colo industry. In particular, many of the smaller colos west of London were bought at knock down valuations by carriers, large third party systems integrators and financial houses. This effectively took that colo space permanently off the market.

Content services: There has been a tremendous infrastructure growth in the last eighteen months by the well known media and content organisations. This includes all the well known names such as Google, Yahoo and Microsoft. It also includes companies delivering newer services such as IP TV and content distribution companies such as Akamai. It could be said with justification, that this growth is only just beginning and these companies are competing directly with the financial community, enterprises and carriers for what little colo space there is left.

Carrier equipment rooms: Most carriers have their own in-house colo facilities to house their own equipment or offer colo services to their customers. Few colos have invested in increasing in these facilities in the last few years so most are now 100% full forcing carriers to go to 3rd party colos for expansion.

Instant use: When enterprises buy space today they immediately use it rather then letting it lie fallow.

How has the Colo industry reacted to this 'Colo 2.0' spurt of growth?

With demand going through the roof and with a limited amount of space available in London, it is clearly a seller's market. Users of colo facilities have seen rack prices increase at an alarming rate. For example: Colocation Price Hikes at Redbus.

However, the rack price graph above does not tell the whole story as power, which used to be a small additional charge or even thrown in for free, have risen by a factor of three or even four in the last twelve months.

Colos used to focus on selling colo space solely on the basis of rack footprints. However, the new currency they use is Amperes, not square feet measured in rack footprints. This is an interesting aspect that is not commonly understood by individuals who have not had to by buy space in the last twelve months.

This is caused because colo facilities are not

only capped in the amount of space they have to place racks, they also have caps on the amount of electricity that a site can take from their local power companies. Also, as a significant

percentage of this input power is turned into heating the hosted equipment, colo facilities have needed to make significant investment in coolers to keep the equipment operating within their

temperature specifications. They also need to invest in appropriate back-up power generators and batteries to power the site in case of a external power failure.

This is caused because colo facilities are not

only capped in the amount of space they have to place racks, they also have caps on the amount of electricity that a site can take from their local power companies. Also, as a significant

percentage of this input power is turned into heating the hosted equipment, colo facilities have needed to make significant investment in coolers to keep the equipment operating within their

temperature specifications. They also need to invest in appropriate back-up power generators and batteries to power the site in case of a external power failure.

Colo contracts are now principally based on the amount of current the equipment consumes, not its footprint. If the equipment in a rack only takes up a small space but consumes, say 8 to 10 Amps, then the rest of the rack has to remain empty unless you are willing pay an additional full-rack's worth of power.

If a rack owner sub-lets shelf space in a rack

to a number of their customers, each one has to be monitored with individual Ammeters placed on each shelf.

If a rack owner sub-lets shelf space in a rack

to a number of their customers, each one has to be monitored with individual Ammeters placed on each shelf.

One colo explains this to their customers in a rather clumsy way:

"Price Rises Explained: Why has there been another price change?

By providing additional power to a specific rack/area of the data floor, we are effectively diverting power away from other areas of the facility, thus making that area unusable. In effect, every 8amps of additional power is an additional rack footprint.

The price increase reflects the real cost to the business of the additional power. Even with the increase, the cost per additional 8amps of power is still substantially less, almost half the cost of the standard price for a rack foot print including up to 8amp consumption."

Another point to bear in mind here is the current that individual servers consume. With the sophisticated power control that is embedded into today's servers - just like your home PC - there is a tremendous difference in the amount of current a server consumes in its idle state compared to full load. The amount of equipment placed in a rack is limited by the possible full load current consumption even if average consumption is less. In the case of an 8 Amp rack limit, there would also be a hard trip installed by the colo facility that turns the rack off if current reaches say 10 Amps.

If the equipment consists of standard servers or telecom switches this can be accommodated relatively easily, but if a company offers services such as interactive games or IPTV service and fills a rack with blade (card) servers, this can quite easily consume 15 to 20kW of power or 60 Amps! I'll leave it you to undertake the commercial negotiations with your colo but take a big chequebook!

What could be the consequences of the up and coming crisis?

The empty floor as seen in the picture are long gone in colo facilities in London.

Virtual hosters caught in a trap: Clearly if a company does not own its own colo facilities but offers colo based services to their customers, it could prove to be very difficult and expensive to guarantee access to sufficient space, sorry Amperage, to meet their customer's growth needs in an exploding market. As in the semiconductor market where fabless companies are always the first hit in boom times, those companies that rely on 3rd party colos could have significant challenges facing them in coming months.

No low cost facilities will hit small hosting companies: The issues raised in this post are significant ones even for multinational companies, but for small hosting companies they are killers. Many small hosting companies who supply SME customers have already put the shutters on their business as it has proved not to be cost effective to pass these additional costs on their customers.

Small Web 2.0 service companies and start-ups: The reduction in availability of low-cost colo hosting could have a tremendous impact on small Web 2.0 service development companies where cash flow is always a problem. Many of these companies used to go to a "sell it cheap" colo but there are fewer and fewer of that can be resorted to. If small companies go to these lower cost colos then you can placing their services in potential jeopardy as the colo might have only one carrier fibre connection to the facility and if that goes down or no power back-up capabilities...

Its not so easy to access lower cost European facilities: There is space available in some mainland European cities and at rates considerably lower than those seen in London. However, their possible use does raise some significant issues:

-

A connection needs to be paid for between the colo centres. If talking about multi Gbit/s bandwidths these does not come cheap. They also need to be backed up by at least a second link for resilience.

-

For real time applications - games or synchronous backup, the addition transit delays can prove to be a significant issue.

-

Companies will need local personal to support your facility and this can be very expensive and also represents an expensive and long term commitment in many European counties.

I called this post a Crisis for the UK Internet and IT industry? I hope that the issues outlined do not have a measurable negative impact in the UK, but I'm really not sure that that will be the case. Even if there is a rush to build new facilities in 2007 it will take 18 to 24 months for them to come on line. If this trend continues, a lot of application and content service providers will be forced to provide them from Europe or the USA with a consequent set of knock-on effects for the UK.

I hope I'm wrong.

Note: I would like to acknowledge a presentation given by Tim Anker of the theColocationexchange at the Data Centres Europe conference in March 2007 which provided the inspiration for this post. Tim has been concerned about this issues and has been bringing to the attention of companies for the last two years.